In recent years, India has witnessed a Mobisafar Login remarkable digital revolution. With rapid advancements in technology and government initiatives promoting digital inclusion, financial services are now reaching even the remotest corners of the country. Mobisafar, a leading player in digital banking and financial services, is a testament to this transformation. Through its innovative platform and accessible login system, Mobisafar is empowering millions by providing secure, convenient, and efficient financial services.

Understanding Mobisafar

Mobisafar is a pioneering financial service provider in India, offering a range of digital banking and financial services, including Aadhaar-enabled payment systems (AePS), domestic money transfer (DMT), and bill payment services. Established with a mission to bridge the gap between urban and rural financial services, Mobisafar has empowered millions of users by making banking and financial transactions easily accessible and affordable.

Through its user-friendly Mobisafar login portal, individuals, business correspondents (BCs), and agents can access a wide range of services, facilitating the smooth operation of financial transactions in rural and underserved regions. By providing financial services through digital channels, Mobisafar aligns with the government’s Digital India initiative, which seeks to improve access to services and promote financial inclusion across the country.

Key Features of the Mobisafar Login Portal

The Mobisafar login portal is designed with simplicity and efficiency in mind, ensuring that users, regardless of their technical expertise, can access and utilize its services seamlessly. Here are some of the key features that make Mobisafar a popular choice among users:

1. Secure Authentication

Mobisafar prioritizes security, with advanced authentication mechanisms to protect user information. Upon login, users are required to enter secure credentials, ensuring that only authorized individuals can access their accounts and perform transactions. The portal’s security measures comply with industry standards, providing users with peace of mind while they engage in financial activities.

2. User-Friendly Interface

The Mobisafar login portal features an intuitive design, making it easy for users to navigate and access services. The streamlined layout minimizes complexities and provides quick access to all essential functions, including money transfers, bill payments, and mobile recharges, ensuring a hassle-free experience for users.

3. Real-Time Transaction Updates

With Mobisafar, users receive real-time updates on their transactions, ensuring transparency and allowing them to track their finances accurately. This feature is particularly beneficial for those in rural areas, who may rely on these updates to confirm successful transactions without needing to visit a bank branch.

4. Multi-Platform Accessibility

The Mobisafar platform is accessible via both web and mobile applications, making it highly versatile. Users can log in to their accounts from their computers or smartphones, ensuring that they can access financial services anytime, anywhere. This accessibility is crucial for users in rural areas, where internet penetration may be limited.

5. Support for Multiple Languages

Recognizing the diversity of India, Mobisafar offers multilingual support on its portal. Users can select their preferred language during login, allowing them to access services in their native language, which enhances user comfort and inclusivity.

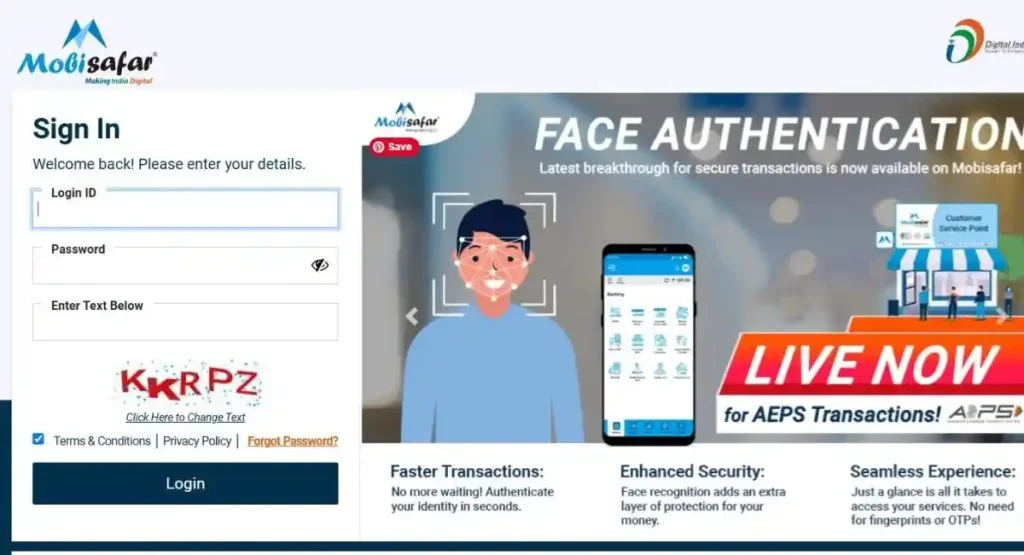

How to Access the Mobisafar Login Portal

Accessing the Mobisafar login portal is simple, and it allows users to connect with various financial services. Here’s a step-by-step guide for logging in:

- Visit the Official Website or App: Open the Mobisafar website or mobile app on your preferred device.

- Click on the Login Button: On the homepage, locate and click on the “Login” button.

- Enter Login Credentials: Enter your username and password. Ensure the information is correct to avoid login issues.

- Complete CAPTCHA Verification (if prompted): For added security, you may be asked to complete a CAPTCHA verification.

- Access Your Account: Once logged in, you can access various financial services, including AePS, DMT, bill payments, and more.

Also Read : MocDoc Login | Gold365 Login | Zen Class Login

Services Offered Through the Mobisafar Login Portal

Mobisafar provides an array of digital financial services tailored to meet the needs of diverse user groups. Below are some of the primary services accessible through the Mobisafar login portal:

1. Aadhaar Enabled Payment System (AePS)

AePS is one of Mobisafar’s flagship services, allowing users to conduct transactions using their Aadhaar number and biometric authentication. This system is particularly beneficial for rural users, as it eliminates the need for traditional bank cards and enhances accessibility to banking services.

2. Domestic Money Transfer (DMT)

Mobisafar’s DMT service enables users to transfer money domestically with ease. By entering the recipient’s details and account number, users can send funds directly to bank accounts across India, promoting seamless financial transactions for both urban and rural customers.

3. Bill Payments and Recharge Services

Mobisafar facilitates bill payments and mobile/DTH recharges, making it convenient for users to manage their expenses without the need for multiple platforms. Users can pay utility bills, recharge their mobile phones, and top-up DTH connections, all from the comfort of their homes.

4. Micro-ATM Services

To extend banking services to remote locations, Mobisafar provides micro-ATM services. Authorized agents can use handheld devices to facilitate cash withdrawals, balance inquiries, and deposits, creating a “mini-bank” experience in underserved areas.

5. Insurance and Loan Services

In partnership with financial institutions, Mobisafar offers insurance and loan services. Through its platform, users can explore loan products and insurance policies, promoting financial literacy and encouraging users to safeguard their future through adequate financial planning.

Benefits of Using the Mobisafar Login Portal

Mobisafar login portal offers a host of benefits to users, agents, and business correspondents, creating a holistic digital ecosystem. Here are some of the main advantages:

1. Financial Inclusion for All

Mobisafar is instrumental in advancing financial inclusion, particularly in rural India. By offering AePS, DMT, and other digital services, it brings banking and financial facilities to those who might otherwise be excluded from the formal banking system.

2. Convenience and Accessibility

With Mobisafar, users can conduct financial transactions from any location, reducing the need to visit a bank branch. This convenience is essential in rural areas, where banks are often far and transportation is limited.

3. Cost-Effective Solutions

Mobisafar login services are affordable, making them accessible to people of all income levels. By providing low-cost financial services, it helps users save money while accessing essential services, promoting financial stability.

4. Reduced Dependence on Cash

Through digital transactions and mobile recharges, Mobisafar reduces the need for physical cash, which aligns with the government’s cashless economy initiatives. This shift encourages safer, traceable transactions, contributing to a more transparent economy.

5. Empowerment of Rural Entrepreneurs

Mobisafar enables individuals to become authorized agents or business correspondents, giving them the opportunity to earn an income by providing financial services in their communities. This model not only boosts local economies but also empowers individuals to contribute to digital financial inclusion.

Mobisafar Login and Digital India: A Collaborative Effort

The government’s Digital India initiative aims to make India a digitally empowered society by enhancing access to digital services and internet infrastructure. Mobisafar’s commitment to financial inclusion aligns with this mission. By digitizing financial services, Mobisafar empowers citizens, enabling them to participate fully in the country’s economic growth.

Through its partnerships with government agencies and banks, Mobisafar is contributing to a more inclusive financial ecosystem. It complements initiatives such as Jan Dhan Yojana, which aims to provide every household with access to financial services, including savings accounts and credit facilities.

Challenges Faced by Mobisafar Login and Solutions

Despite its success, Mobisafar faces certain challenges. These include:

- Limited Internet Penetration in Rural Areas: Some regions still lack internet access, which can hinder the adoption of digital services. To address this, Mobisafar works closely with telecom providers to enhance connectivity.

- Low Financial Literacy Levels: Many users are unfamiliar with digital financial services. Mobisafar offers educational programs and training sessions to bridge this knowledge gap, ensuring that users understand how to make the most of digital banking.

- Security Concerns: While Mobisafar prioritizes security, concerns about data breaches persist. The platform continually upgrades its security measures and employs robust authentication methods to maintain user confidence.

The Future of Mobisafar and Digital Financial Services

As India’s digital landscape evolves, Mobisafar is poised to expand its reach and enhance its services. The platform is continually innovating, with plans to integrate new financial products, such as investment and wealth management services. Mobisafar also intends to strengthen its presence in Tier-3 and Tier-4 cities, ensuring that more communities benefit from digital financial inclusion.

Mobisafar’s vision aligns with the government’s goal of creating a cashless, financially inclusive society, making it a vital player in India’s digital economy.

Also Read: Guvi Login | Veltech Student Login | Brainware University Login

Conclusion

The Mobisafar login portal is more than just an entry point to a digital financial platform; it represents a significant step toward financial empowerment for millions of Indians. By providing accessible, secure, and efficient financial services, Mobisafar Login plays a critical role in promoting Digital India and ensuring that every citizen, regardless of location, can participate in the nation’s economic progress.

As Mobisafar continues to innovate and expand, its contribution to India’s digital ecosystem will grow, paving the